현재 장바구니가 비어 있습니다!

[2024-07-31 Korea Economic News] Top 7 Stocks with Highest Short Selling Balances on KOSPI: Which Ones are Standout Winners?

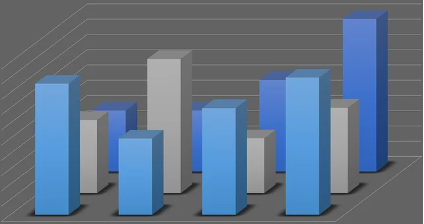

KOSPI Short Selling Trends: Top 50 Stocks

The KOSPI market has been witnessing significant activity in terms of short selling. In this article, we will delve deeper into the current trends regarding the short selling balance of the top 50 listed stocks on the KOSPI index. Let’s explore the stocks leading the charge in terms of short selling, examining their rankings, total amounts, and the corresponding shares held.

Focus on Stocks: Major Players in Short Selling

Among the top 50 stocks with the highest short selling balance, we can observe several notable participants. Key players include POSCO Future M, LG Energy Solution (known as Elan F), Lotte Tour Development, Doosan Fuel Cell, Hotel Shilla, Myungshin Industry, and SKC. These companies have captured investor interest through their varying degrees of short selling activity, showcasing contrasting market sentiments.

Short selling—a strategy wherein investors sell borrowed shares with the hope of buying them back at a lower price—has become an increasingly prevalent tactic within the KOSPI market. It’s essential to understand how the short selling balance, along with its ranking and weight, can influence market dynamics and investor decisions.

Understanding Short Selling: The Balance and Implications

The short selling balance reflects the total number of borrowed shares that investors have sold but have yet to repurchase. This is often indicative of bearish sentiment towards a stock or sector. When we assess the rankings and amounts, it becomes clear which companies are being heavily targeted by short sellers. For example, POSCO Future M and Elan F show substantial short selling balances, suggesting that investors might be anticipating downtrends in their stock prices.

Furthermore, analyzing the proportion of short selling in relation to the total share volume helps us gauge the level of market skepticism. A high percentage may indicate a prevailing sense of caution or expectation of future declines among investors. This leads to discussions about market sentiment regarding these companies and, by extension, the broader market outlook.

Insights into Market Sentiment: KOSPI’s Leading Stocks

As we dive deeper into the specifics of the top stocks listed in the KOSPI short selling rankings, we notice that heavyweights like POSCO Future M are pivotal. The anticipation surrounding these stocks often correlates with broader economic indicators and industry performance. The short selling percentage serves as a barometer for investor sentiment, allowing stakeholders to adjust their strategies accordingly.

Moreover, external factors such as economic forecasts, regulatory changes, and industry trends can play a significant role in influencing these short selling balances. By keeping an eye on the companies mentioned above and their respective shares’ performance, investors can better position themselves in the ever-changing landscape of the stock market.

Conclusion: A Look Ahead at KOSPI Stocks

In summary, understanding the short selling balance within the KOSPI market yields valuable insights into the current market movements and investor behaviors surrounding specific stocks. As we’ve examined, POSCO Future M, LG Energy Solution, and several others dominate the short selling rankings, highlighting the complex relationship between investor sentiment and market performance.

It’s crucial for investors to stay informed about these trends. Being aware of the short selling balance can aid in making informed investment decisions during fluctuating market conditions. Engaging in short selling comes with its risks, but it can also provide opportunities for profit if approached intelligently.

For anyone interested in gaining more insights into the dynamic landscape of the KOSPI index and its short selling balances, I encourage you to keep researching and exploring. For comprehensive information on various topics, visit WalterLog and discover valuable content that could enhance your understanding and investment strategies.